I had just paid the bill via a UPI app at my neighbourhood quick-service restaurant—or ‘Darshini’ as it’s known in Bangalore. Realizing I didn’t have cash for a tip, I asked the waiter for his phone number and transferred ₹100 directly to him via the app. It was a generous gesture, but as I walked out, it struck me: I would’ve never tipped that much if I were handing over a crisp ₹100 note in person.

The intermediary of a payment app had made the expense feel painless.

Reflecting on other small transactions, I realized I often spent more via UPI than I would with physical cash. What I was experiencing is a well-documented phenomenon in behavioural economics: the “Pain of Paying.” It’s the discomfort we feel when parting with money, rooted in loss aversion—our tendency to perceive losses as more significant than equivalent gains.

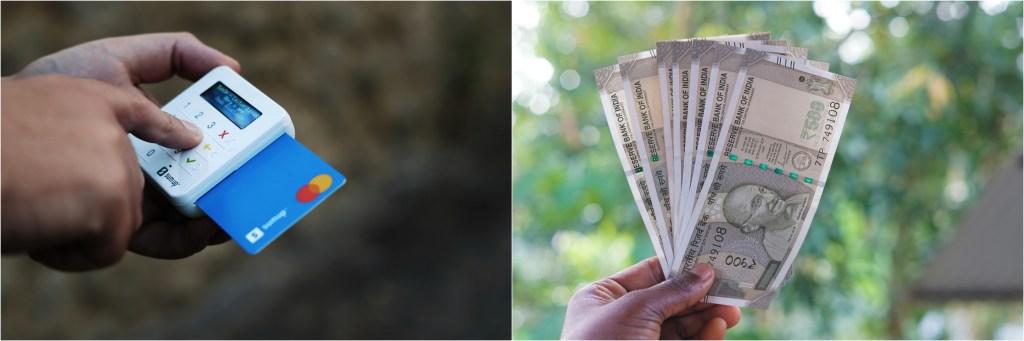

Cash, with its tactile and visible nature, triggers this pain more sharply. UPI payments, though debited from our savings accounts, feel less immediate and less painful. And now, UPI-enabled credit card payments could make this pain almost vanish altogether.

UPI has transformed India’s payments ecosystem. According to the RBI Annual Report (May 2025), India accounted for a staggering 48.5% of global real-time payment volume in FY25, driven by UPI. It now supports cross-border payments with countries like the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius.

The next frontier? Integrating credit cards into UPI apps—allowing consumers to use their credit lines while retaining the instant, seamless convenience of UPI.

A recent ad by a popular payment app showed four friends at a café. One complains about an expensive cheese board. The server informs them that the card machine is down—but they’re relieved to learn they can pay via credit card on the app. The implicit message: no more awkward money conversations, just tap and pay.

But this seemingly harmless ad masks a deeper issue. By merging credit cards with UPI’s frictionless experience, the psychological guardrails around spending erode even further.

Credit cards already reduce the pain of paying by deferring actual payments. Wrapped inside UPI’s ease, they can become dangerously invisible. Now, even large or impulsive purchases don’t feel like expenses at all.

As per a 2025 survey by the Ministry of Statistics and Programme Implementation:

- ~96% of Indians aged 15–29 own smartphones

- 99% of these users, report being able to perform UPI transactions

That’s near-total penetration among a population still building financial habits—and often unfamiliar with credit billing cycles, interest charges, or limits. The risk isn’t limited to youth: with the explosion of online gaming and fantasy apps, the temptation of instant wealth has created debt traps across demographics.

Fintech apps have expanded access—but access must be accompanied by accountability. Now is the time for these platforms to:

- Introduce in-app nudges that prompt users before high-value credit transactions

- Set default spending limits for new users

- Provide clear, simple education around credit terms and repayment cycles

The journey from cash to UPI has been one of India’s greatest fintech success stories. But as we move into the next phase—where UPI meets credit—we must ask a crucial question:

Just because it’s easier to pay, should it be easier to spend? If fintech wants to continue building for India’s future, it must now design not just for inclusion, but for intention.